PolygrAI for KYC/IDV

Streamline customer onboarding and regulatory compliance by combining dynamic AI driven interviews with advanced identity verification workflows.

We have been featured on

See All Features

Benefits

The benefits you will get on our platform

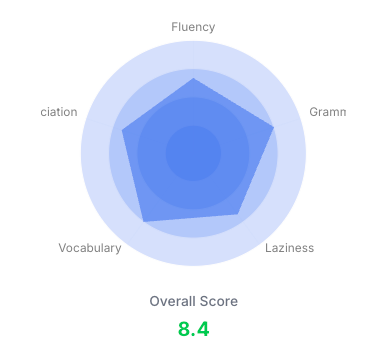

Rapid Risk Assessment

Leverage intelligent interviews that detect inconsistencies and risk signals in real time reducing manual review time.

Continuous Compliance Monitoring

Schedule periodic re verification sessions to maintain audit readiness and meet evolving regulations.

Enhanced Self-Awareness

Leverage analysis of speech patterns and body language to gain deeper understanding of your habits and presentation style.

Encrypted Audit Trails

Store every session in a tamper proof log with full timestamps version history and role based access controls.

Instant Anomaly Alerts

Receive real time notifications when mismatches or suspicious behaviors occur enabling immediate action.

Features

Advanced features that can help you

Our platform empowers you with advanced capabilities to secure onboarding and satisfy the most rigorous regulatory standards.

Adaptive Interview Flows

AI adjusts challenge questions on the fly probing deeper whenever answers diverge from expected patterns ensuring no risk signal goes unnoticed.

Document and Biometric Verification

Integrate computer vision OCR for ID and document authentication alongside automated facial recognition to confirm user identity against trusted sources.

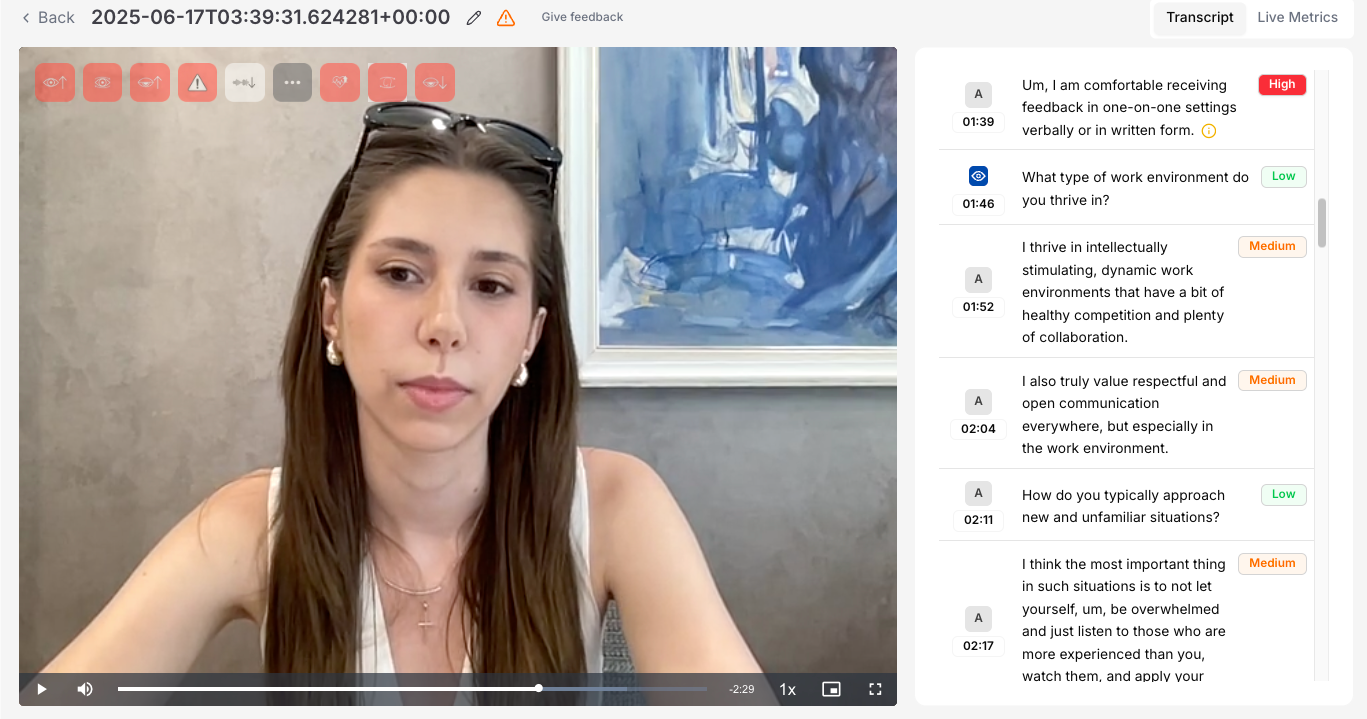

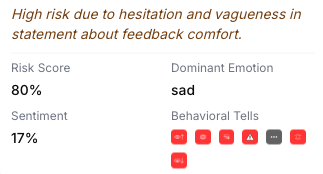

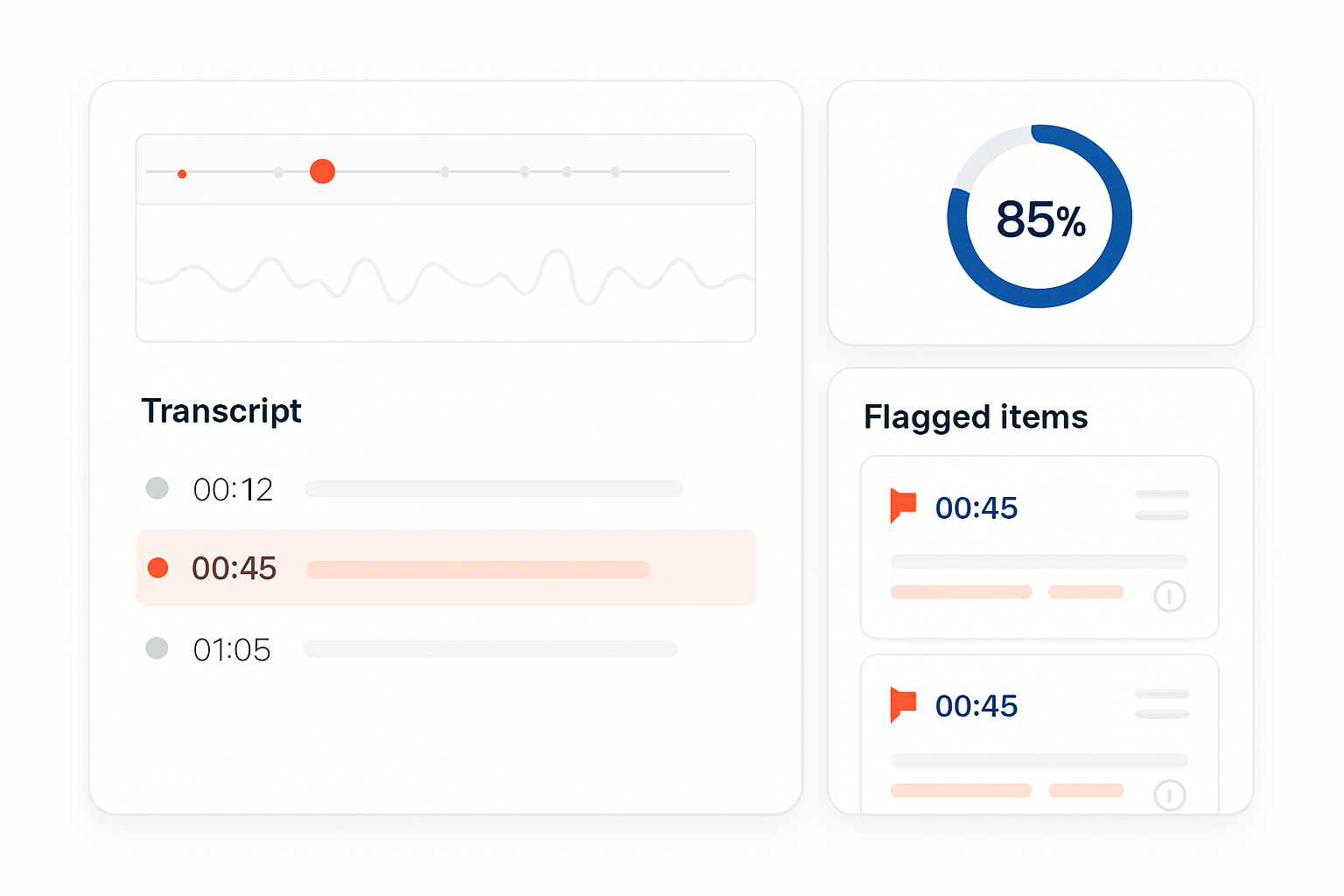

Risk Alerts

Post-session reports flag any answers or behavior patterns suggestive of potential fraud, enabling your team to review highlighted segments promptly and take informed action.

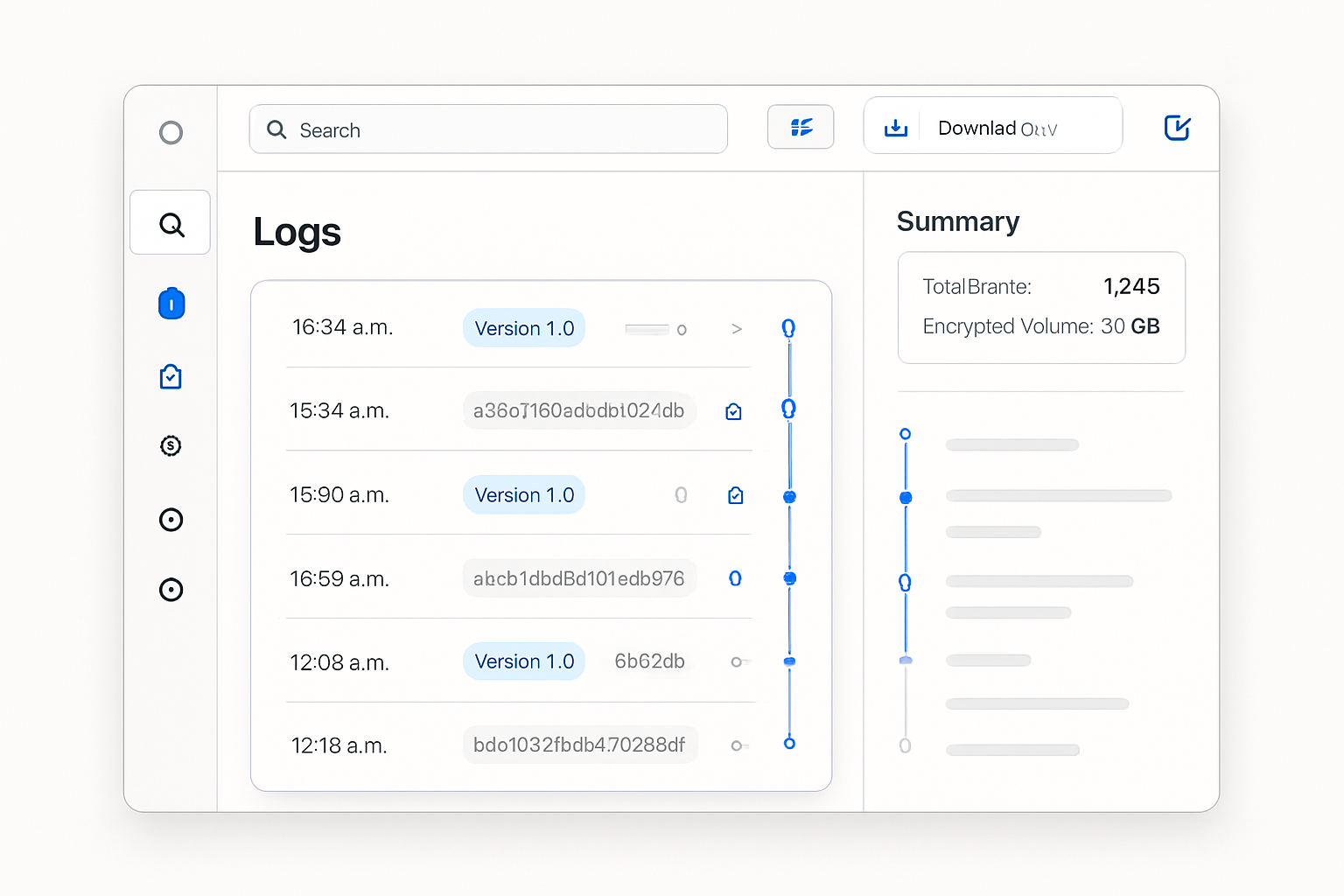

Audit Ready Compliance Logging

Every interaction is encrypted versioned and stored with immutable records that satisfy audit requirements and simplify regulatory reporting.

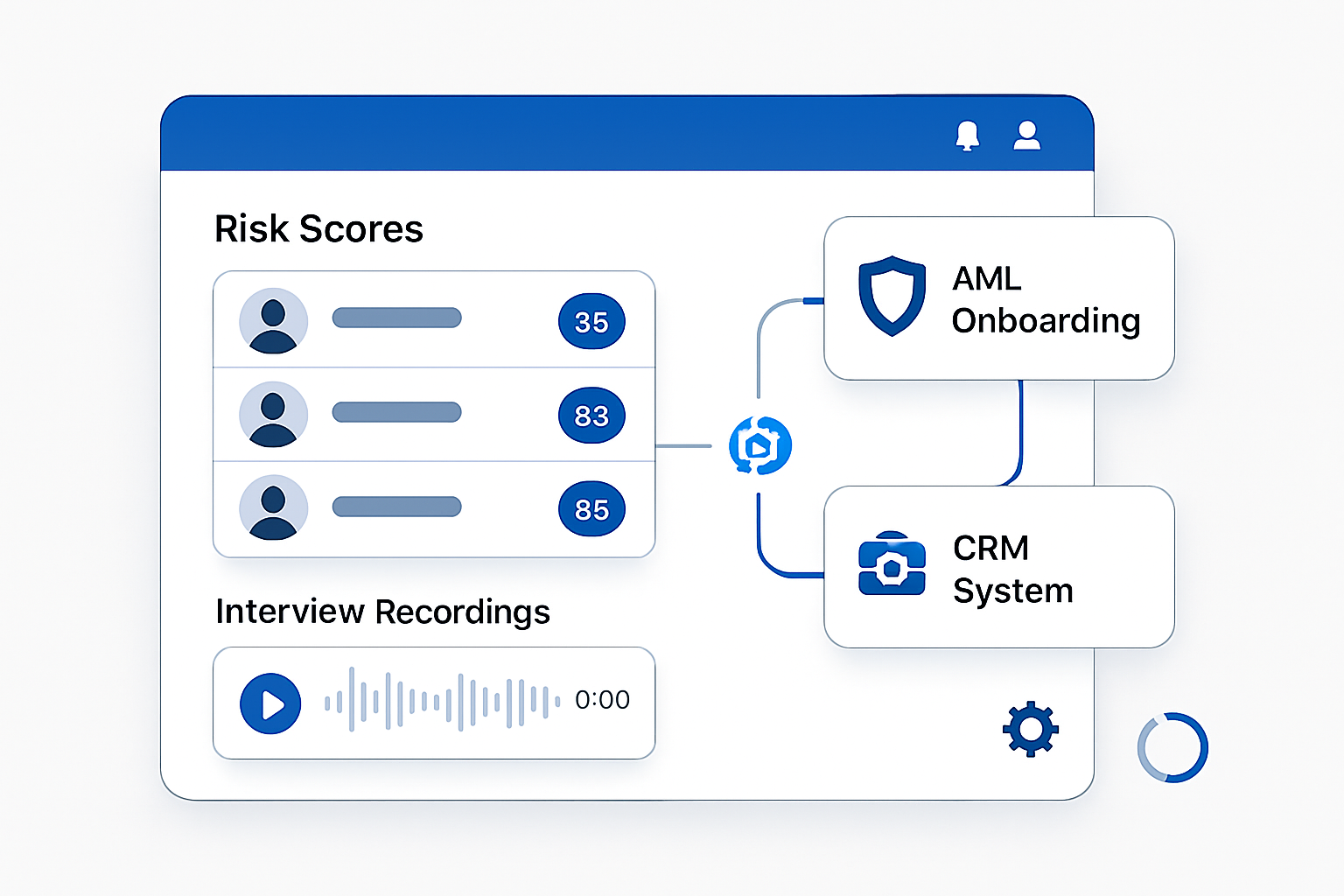

Seamless System Integration

Push verified profiles risk scores and interview recordings directly into your AML onboarding and CRM systems for end to end workflow automation.

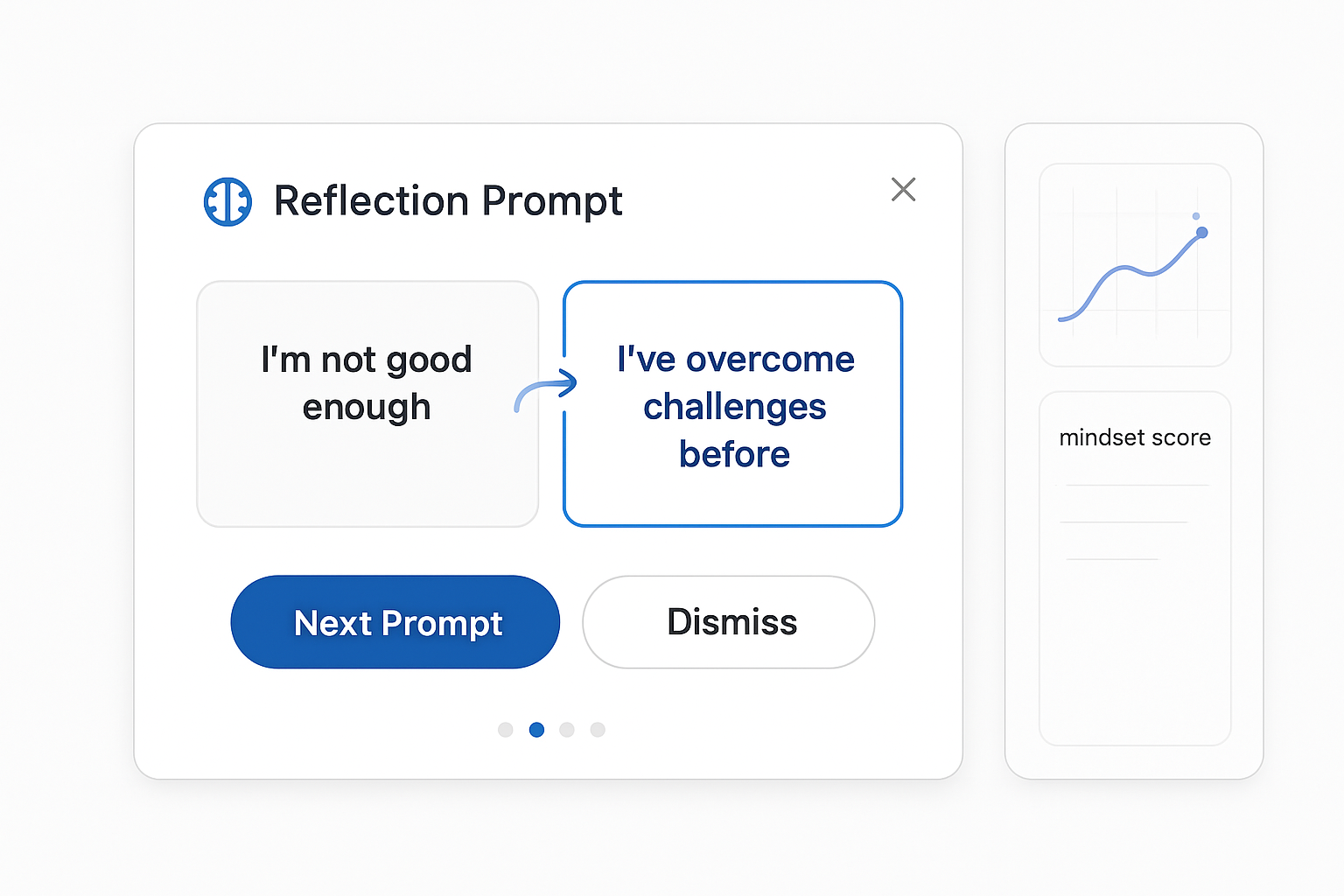

Mindset Reflection Triggers

Activate on-demand deep-dive moments when the system detects limiting beliefs or negative patterns to guide you toward constructive reframing and positive momentum.

How AI Interviews Are Impacting KYC / IDV

Traditionally KYC and identity verification required manual reviews of static documents and faced delays that frustrated legitimate customers and exposed institutions to risk. PolygrAI replaces this rigid model with a living adaptive engine that blends intelligent questioning with cutting edge biometric verification. From the first interaction our system not only asks the right challenge questions but evaluates the consistency of responses in context. When a user uploads a government ID our computer vision module extracts data via OCR validates the document and confirms liveness through facial analysis all within the interview flow.

As each answer arrives the AI assesses voice stress language patterns and facial micro expressions watching for subtle signs of deception or fraud. If at any point inconsistency emerges or a behavior pattern deviates from the established baseline an alert fires instantly so you can escalate the case for manual review if needed. This continuous risk monitoring extends beyond initial onboarding. For accounts flagged as high risk you can schedule automated re verification sessions at chosen intervals ensuring ongoing compliance without burdening your operations team.

Every step of the process is recorded in tamper proof logs complete with precise timestamps and version tracking. This audit ready record keeping meets regulatory demands and offers full transparency for compliance officers. When it is time to report to regulators PolygrAI empowers you with concise yet comprehensive compliance summaries that highlight verification results flagged anomalies and recommended remediation actions. The result is a seamless cycle of prevention detection and response that safeguards your institution and delivers a frictionless experience for your customers.

FAQ

Frequently Asked Questions

Our system dynamically modifies challenge questions in real time probing deeper whenever responses indicate potential inconsistency or fraud.

We support all major government IDs passports driver licenses and use OCR facial recognition and liveness detection for robust ID validation.

All data is encrypted end to end with immutable audit logs version history and role based access controls ensuring maximum privacy and integrity.

Yes our flexible connectors push verified profiles risk assessments and transcript data directly into your preferred AML onboarding and CRM systems.

You can configure re verification at any interval from days to months ensuring compliance refresh requirements are met without manual effort.

No it augments your team by surfacing high risk cases early so that experienced analysts can focus on complex investigations.

Reports are generated on demand summarizing session outcomes flagged anomalies timestamps and recommended next steps in a format compliant with regulatory standards.

Try PolygrAI For Free

Ready to secure your onboarding process with AI driven KYC and identity verification?