PolygrAI for Insurance

Transform insurance workflows by automating claim intake, fraud detection, and tailored customer interviews using AI-driven analytics, accelerating settlements, reducing losses, and enhancing overall policyholder satisfaction.

We have been featured on

See All Features

Benefits

The benefits you will get on our platform

Speed Up Claims Validation

Automate claims screening interviews to verify loss details in minutes and reduce manual review.

Enhance Underwriting Accuracy

Use AI scored applicant interviews to assess risk factors and set more precise policy terms.

Stay Ahead of Emerging Risks

Schedule regular policyholder check ins to detect changes in behaviour or circumstances early.

Prevent Fraud Proactively

Integrate real-time fraud detection analytics into every claims interview to flag suspicious patterns.

Deepen Customer Engagement

Personalize communications with AI insights on sentiment and intent to build trust and loyalty.

Maintain Audit Ready Compliance

Store all underwriting and claims interviews in secure encrypted logs for regulatory review.

Features

Advanced features that can help you

Automate claims screening interviews streamline underwriting risk assessments schedule regular policyholder reviews integrate fraud detection analytics personalize customer sessions and maintain secure audit records all from one unified platform built for modern insurance companies.

Automated Claims Screening

Deploy AI driven interviews to confirm loss details and coverages in minutes so claims can move forward without delay.

Underwriting Risk Assessment

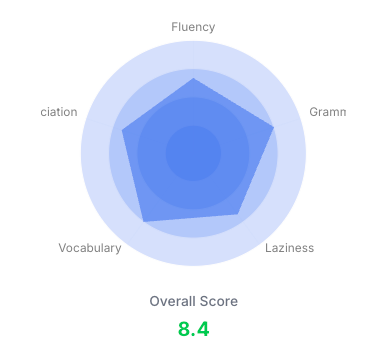

Use multimodal AI scoring of applicant interviews to evaluate driver history health factors or property risks more accurately.

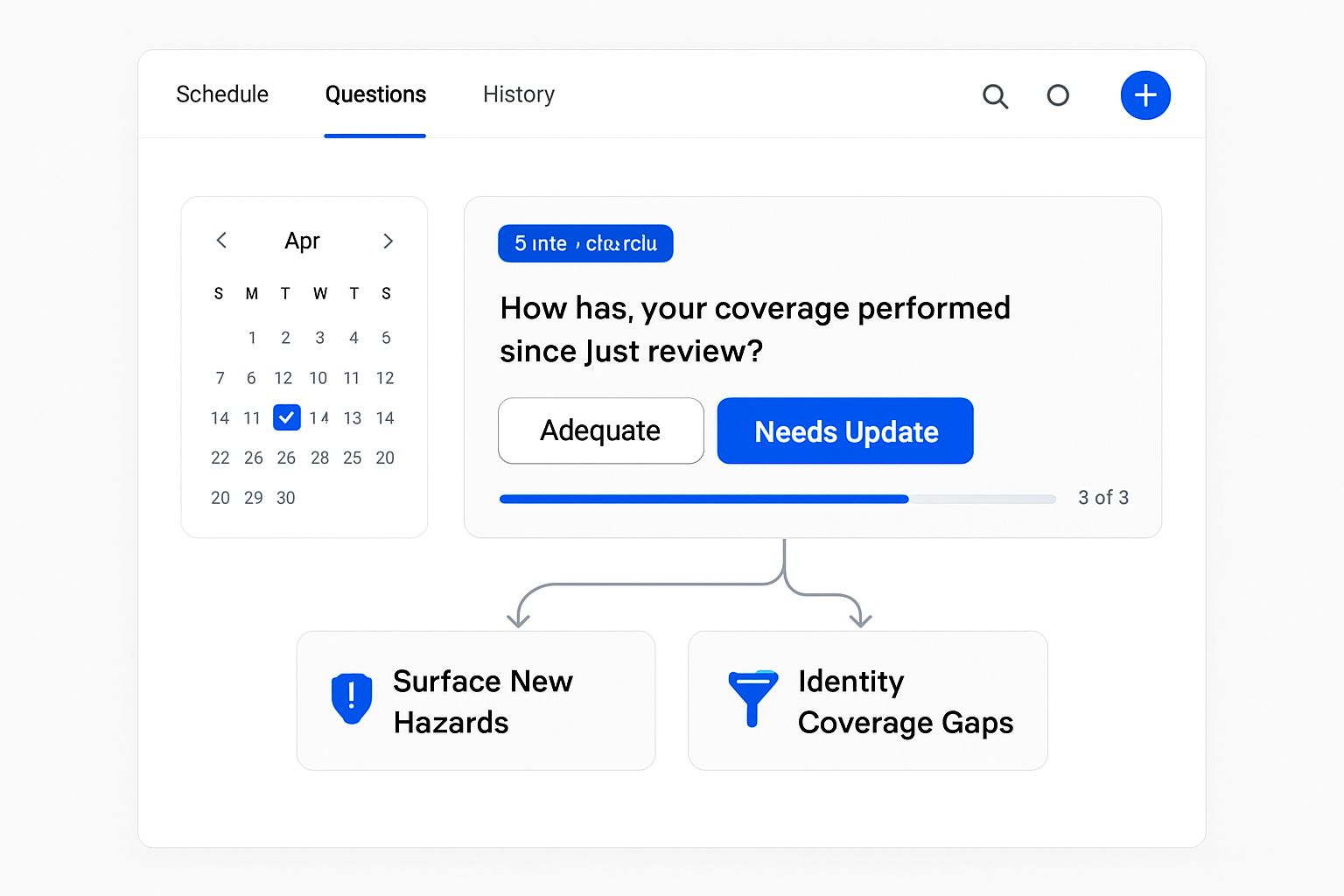

Recurring Policyholder Reviews

Schedule ongoing check ins that adapt questions based on prior responses to surface new hazards or coverage gaps.

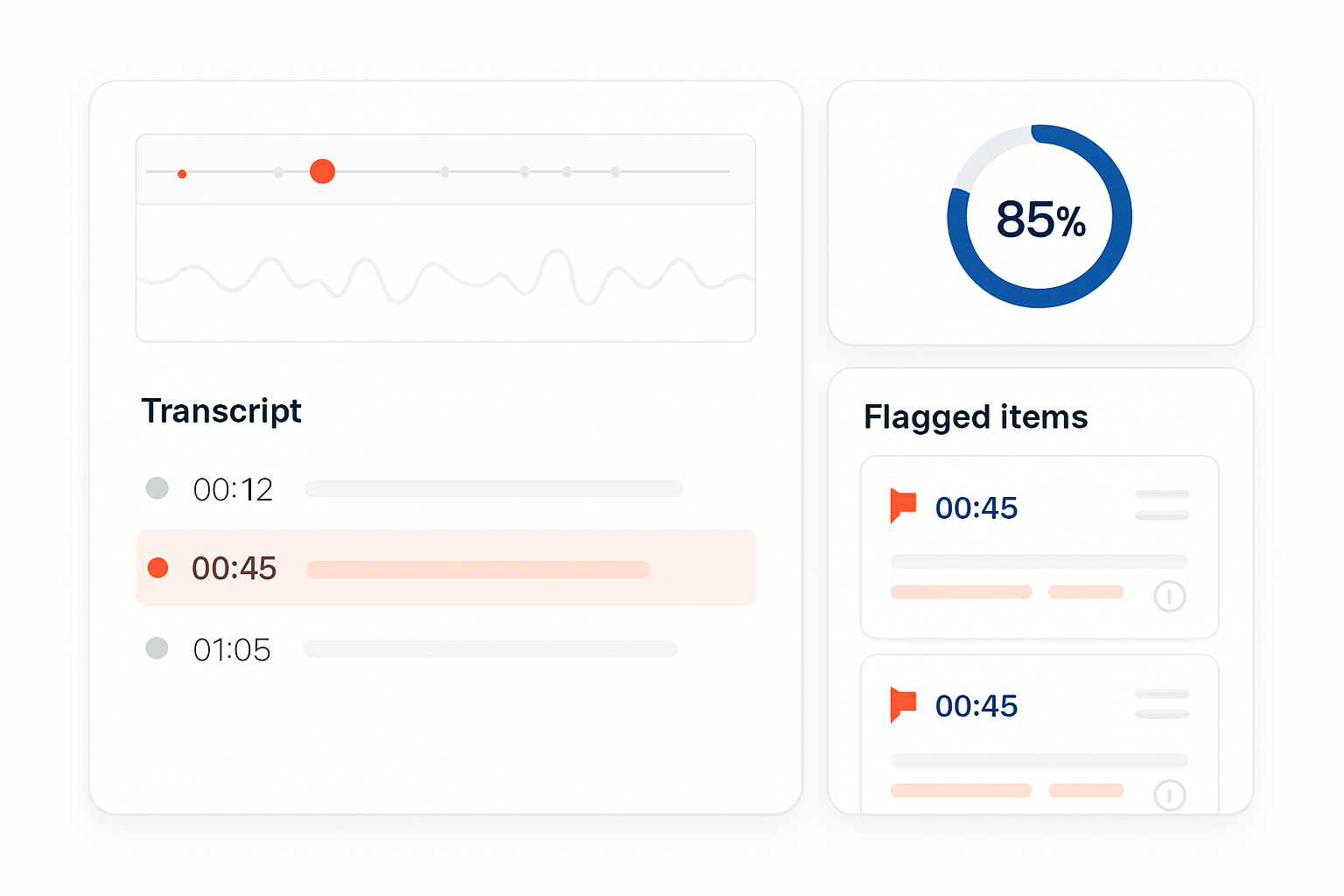

Fraud Detection

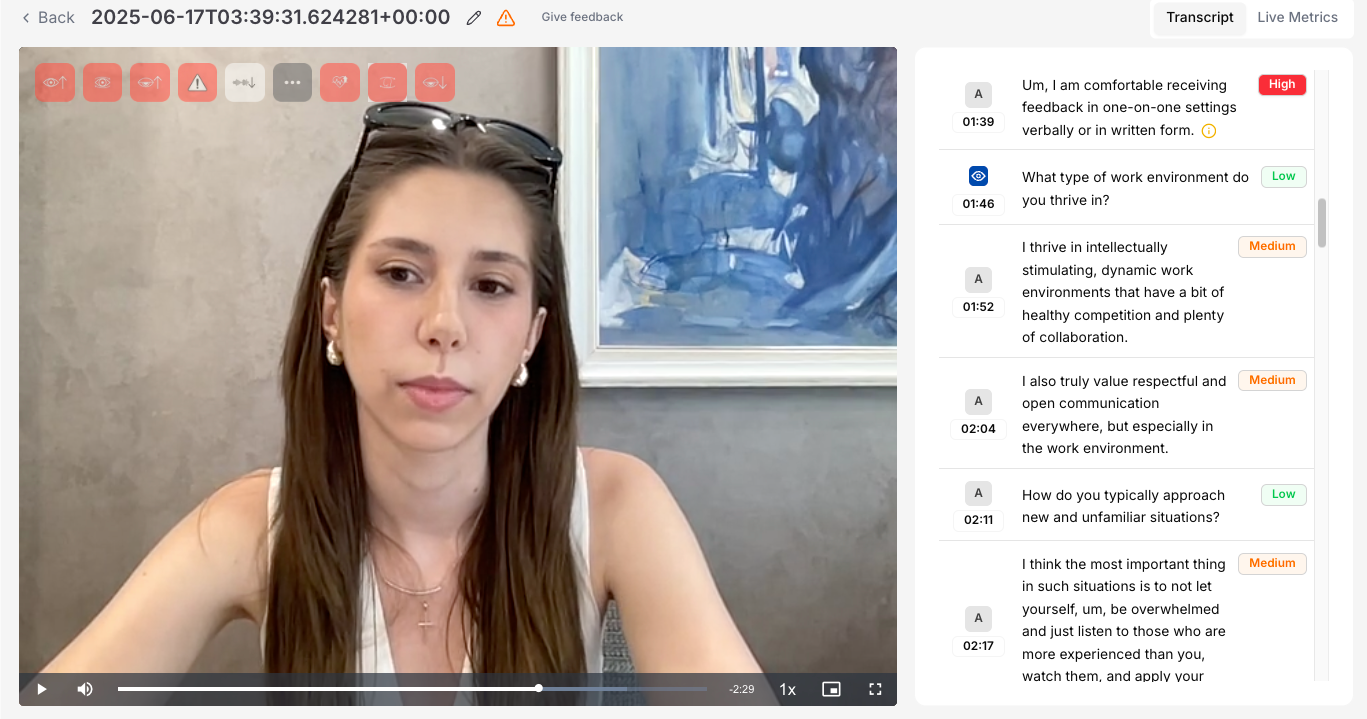

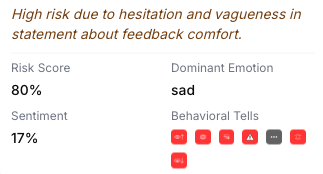

Analyze recorded interviews to detect anomalies in story consistency, tone, or micro-expressions and include these insights in comprehensive post-session reports.

Sentiment Driven Customer Communications

Analyze sentiment and intention in policyholder responses to tailor follow up messages and advise on relevant products.

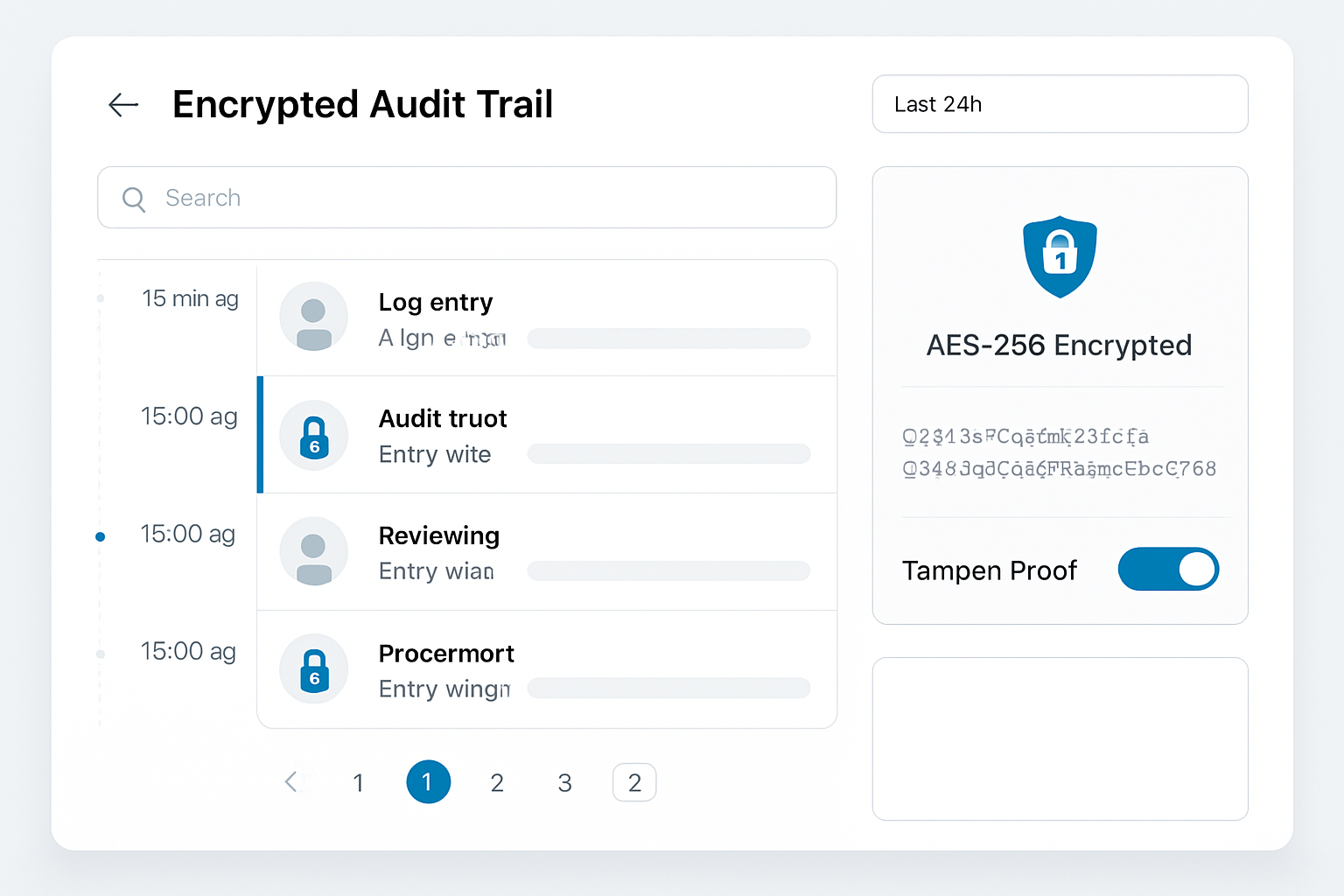

Encrypted Audit Trail

Capture every interview interaction in tamper-proof proof encrypted logs to satisfy compliance and audit requirements.

How AI Interviews Are Impacting Insurance

Insurance leaders face mounting pressure to settle claims quickly while safeguarding against fraud and rising risk. Manual interviews and static questionnaires slow the process and miss subtle cues that indicate misrepresentation or emerging hazards. PolygrAI redefines this workflow by automating AI powered interviews at every touch point.

When a claim is filed our platform launches a brief guided interview that captures visual, vocal and linguistic indicators of truthfulness. Insurers receive instant validation of loss details, accelerating payouts for honest claims and flagging potential fraud for deeper review. Underwriting teams use similar AI scored interviews to probe risk factors in new applications, balancing speed with precision in policy issuance.

Regular policyholder reviews keep insurers informed of life changes or evolving property conditions that affect coverage. With real time fraud detection built into every session, suspicious patterns trigger alerts before losses escalate. Meanwhile sentiment analysis informs customer outreach, enabling proactive service that strengthens loyalty and reduces churn. All data and transcripts are stored in encrypted audit trails, ensuring full regulatory compliance.

By transforming interviews into strategic data engines, PolygrAI empowers insurance companies to improve claim outcomes, tighten fraud controls and deliver a customer experience that sets them apart in a competitive market.

FAQ

Frequently Asked Questions

AI insurance claims screening automates interviews with claimants to verify loss details, analysing multimodal cues for speed and accuracy.

PolygrAI conducts AI scored applicant interviews that assess risk factors in health, driving or property to inform policy decisions.

Yes you can configure recurring AI driven interviews that adapt to each policyholder’s history and surface new risks.

Absolutely all interviews and analytics are encrypted and stored in tamper-proof logs to meet industry and regulatory standards.

.

views and analytics are encrypted and stored in tamper proof logs to meet SOC-2, HIPAA and financial regulatory standards.

Most insurers integrate via API and start conducting AI-powered interviews within days, realising faster claims and underwriting workflows almost immediately.

Try PolygrAI For Free

Ready to transform your insurance operations with AI driven interviews?