PolygrAI for Mergers & acquisitions

Accelerate due diligence, streamline integration planning, and ensure compliance for seamless M&A outcomes.

We have been featured on

See All Features

Benefits

The benefits you will get on our platform

Speed Up Deal Screening

Automate target-company interviews to evaluate financial, legal, and operational fit in minutes.

Improve Stakeholder Debates

Streamline executive and board Q&A sessions with AI-driven follow-ups for sharper insights.

Monitor Integration Progress

Schedule recurring check-ins to track cultural and process alignment throughout integration.

Uncover Risks & Synergies

Integrate real-time risk and synergy analytics into every diligence and planning session.

Maintain Audit-Ready Records

Preserve encrypted transcripts of all interviews to satisfy compliance and reporting needs.

Focus Post-Merger Actions

Generate tailored integration checklists based on AI-identified gaps and opportunity areas.

Features

Advanced features that can help you

Automate screening interviews, streamline stakeholder Q&As, schedule integration updates, embed real-time analytics, preserve secure transcripts, and generate tailored follow-ups—all from one unified platform built for modern M&A workflows.

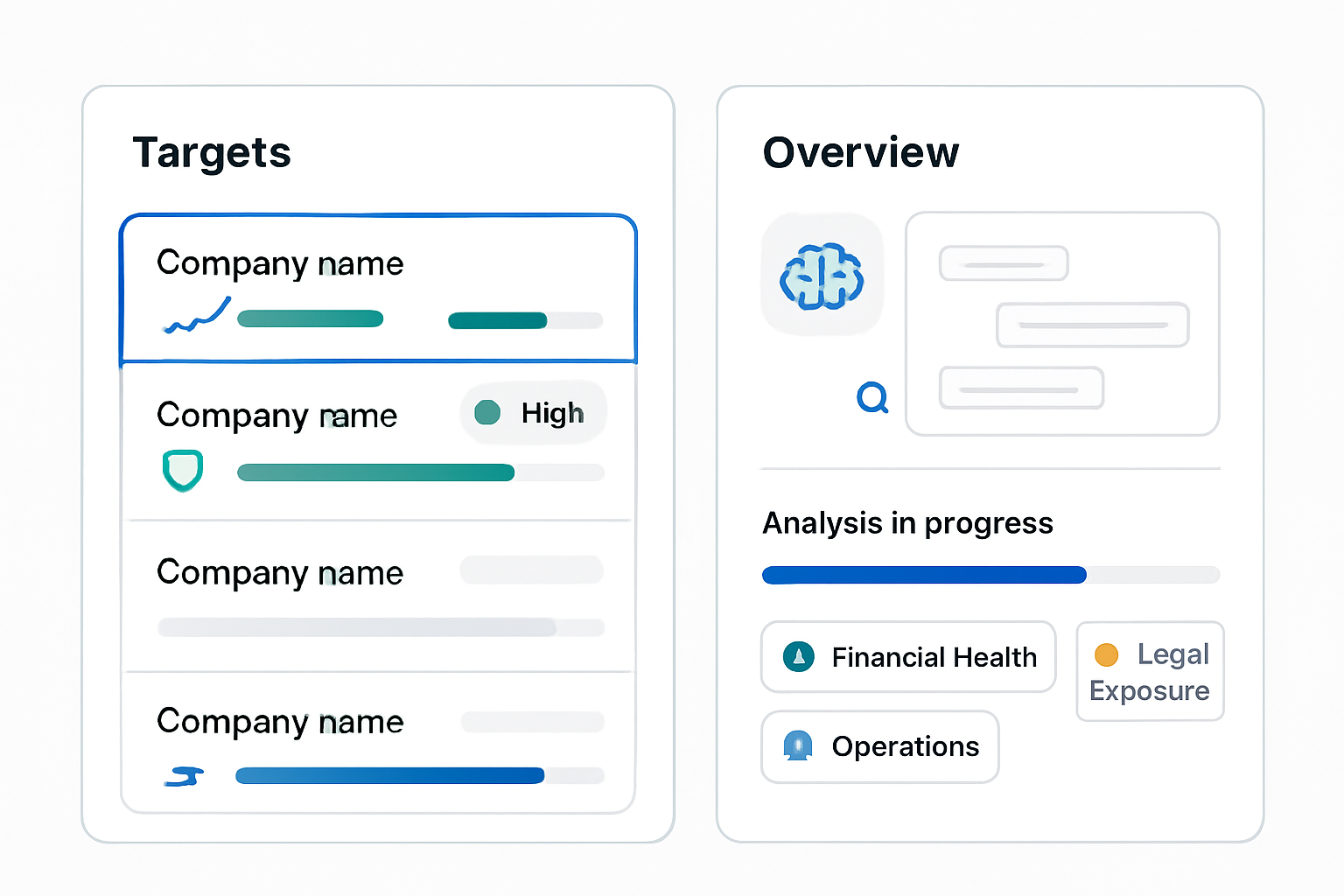

Automated Target Screening

Launch AI-powered interviews to probe financial health, legal exposure, and operational capabilities of acquisition targets.

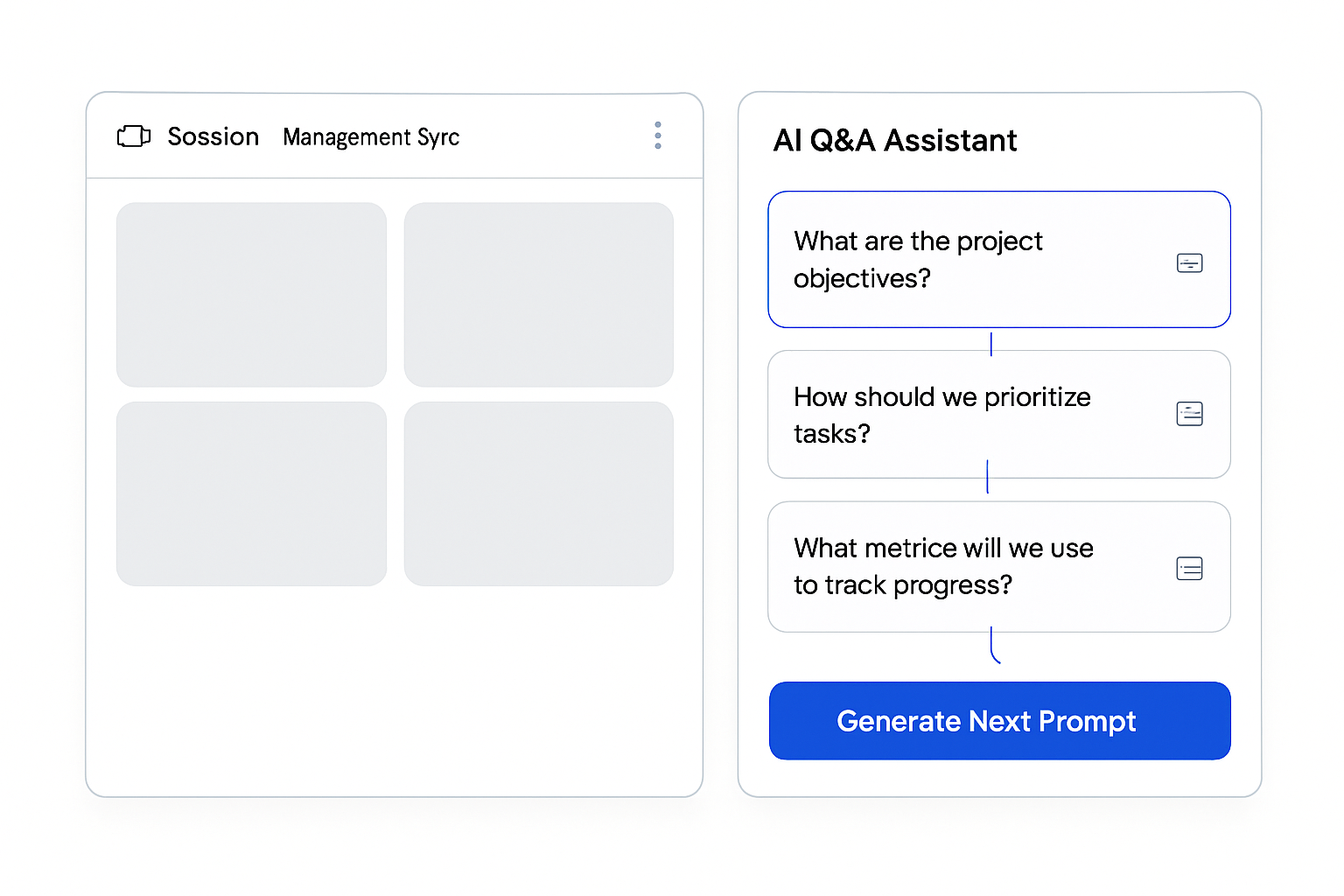

Executive Q&A Automation

Use dynamic AI-driven prompts during stakeholder meetings to clarify strategy and uncover hidden risks.

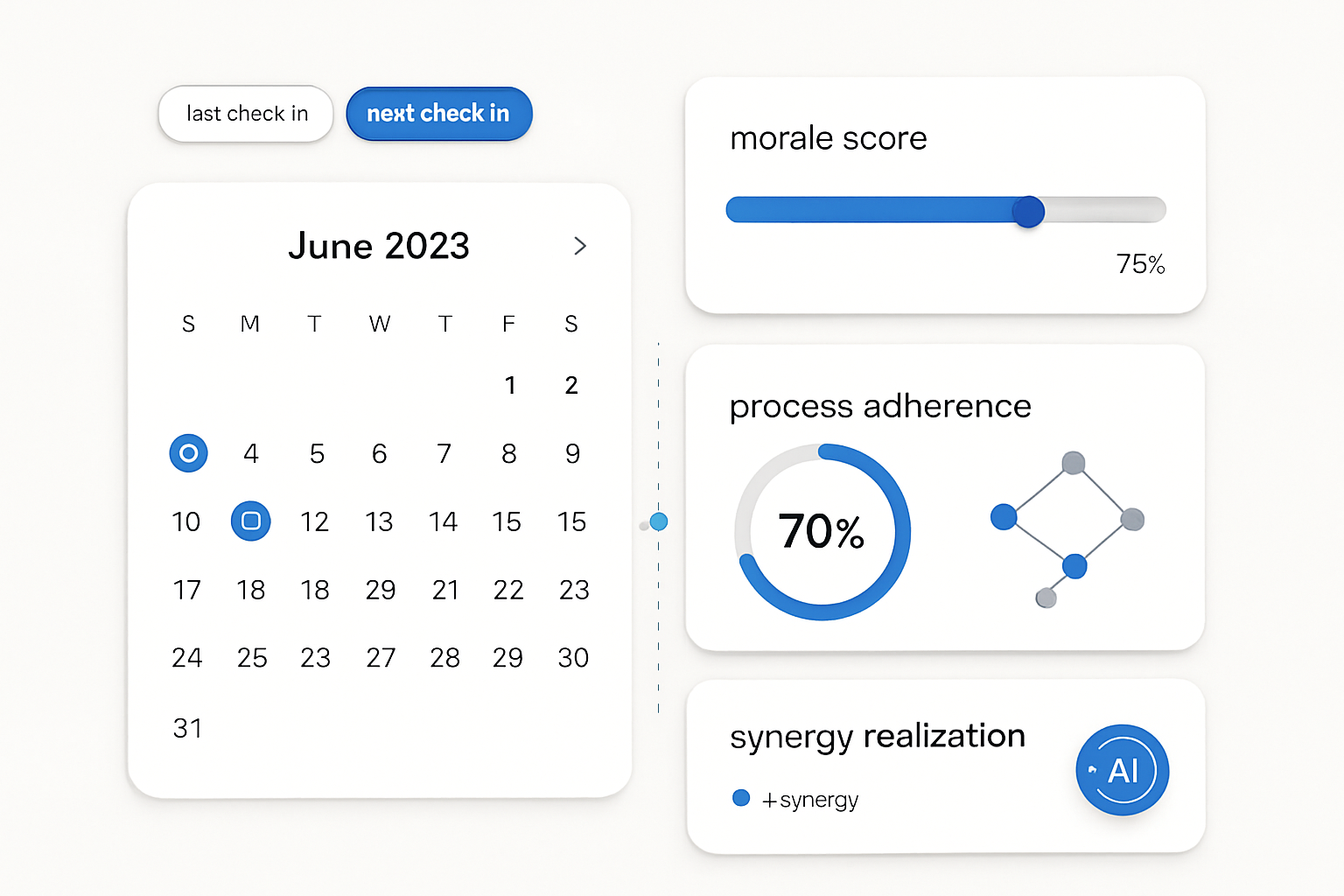

Recurring Integration Check-Ins

Configure periodic AI interviews to monitor team morale, process adherence, and synergy realization.

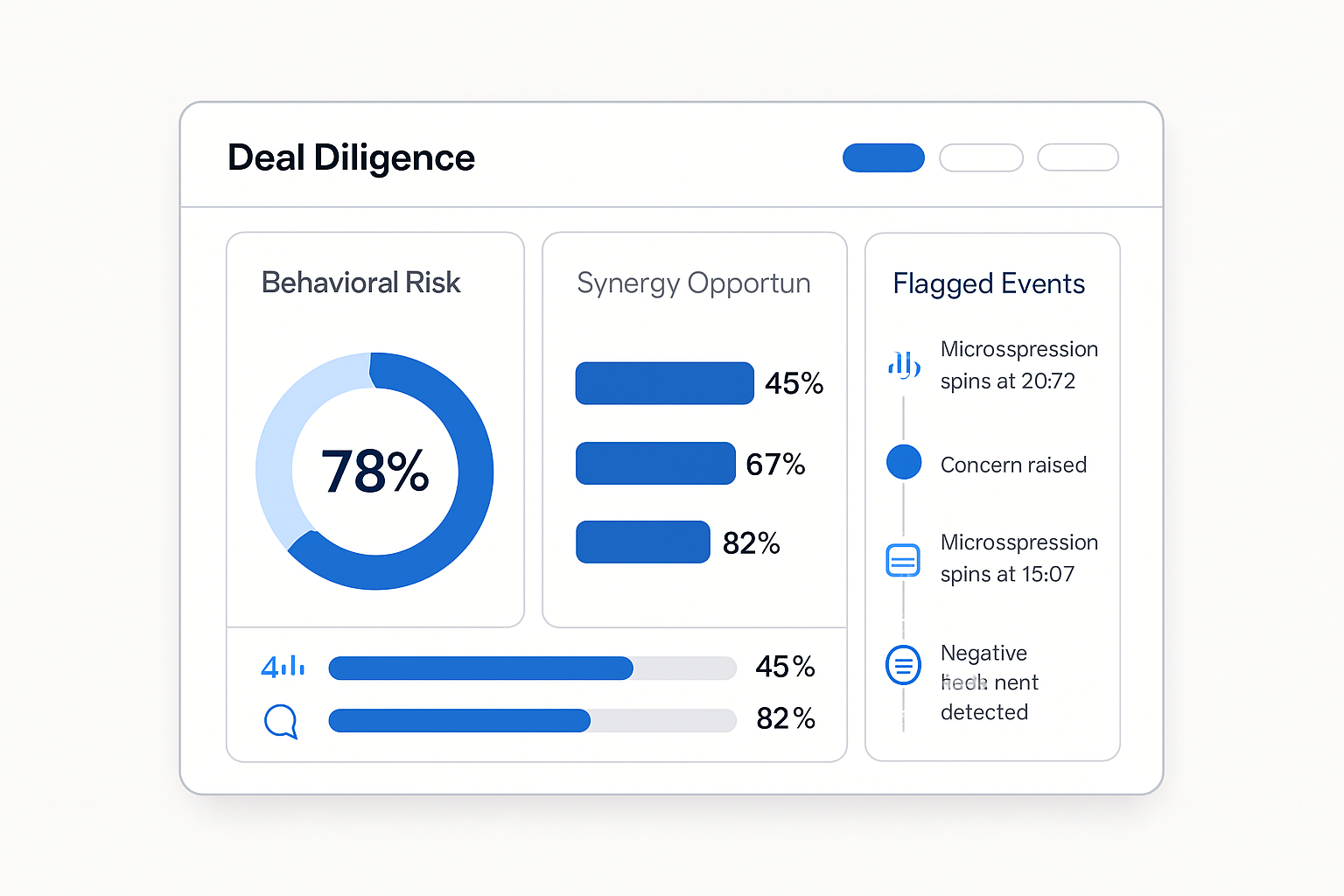

Risk & Synergy Analytics

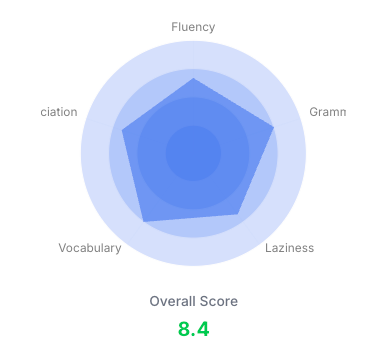

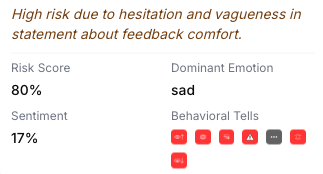

Embed behavioral and linguistic analytics into diligence sessions to surface deal risks and value opportunities instantly.

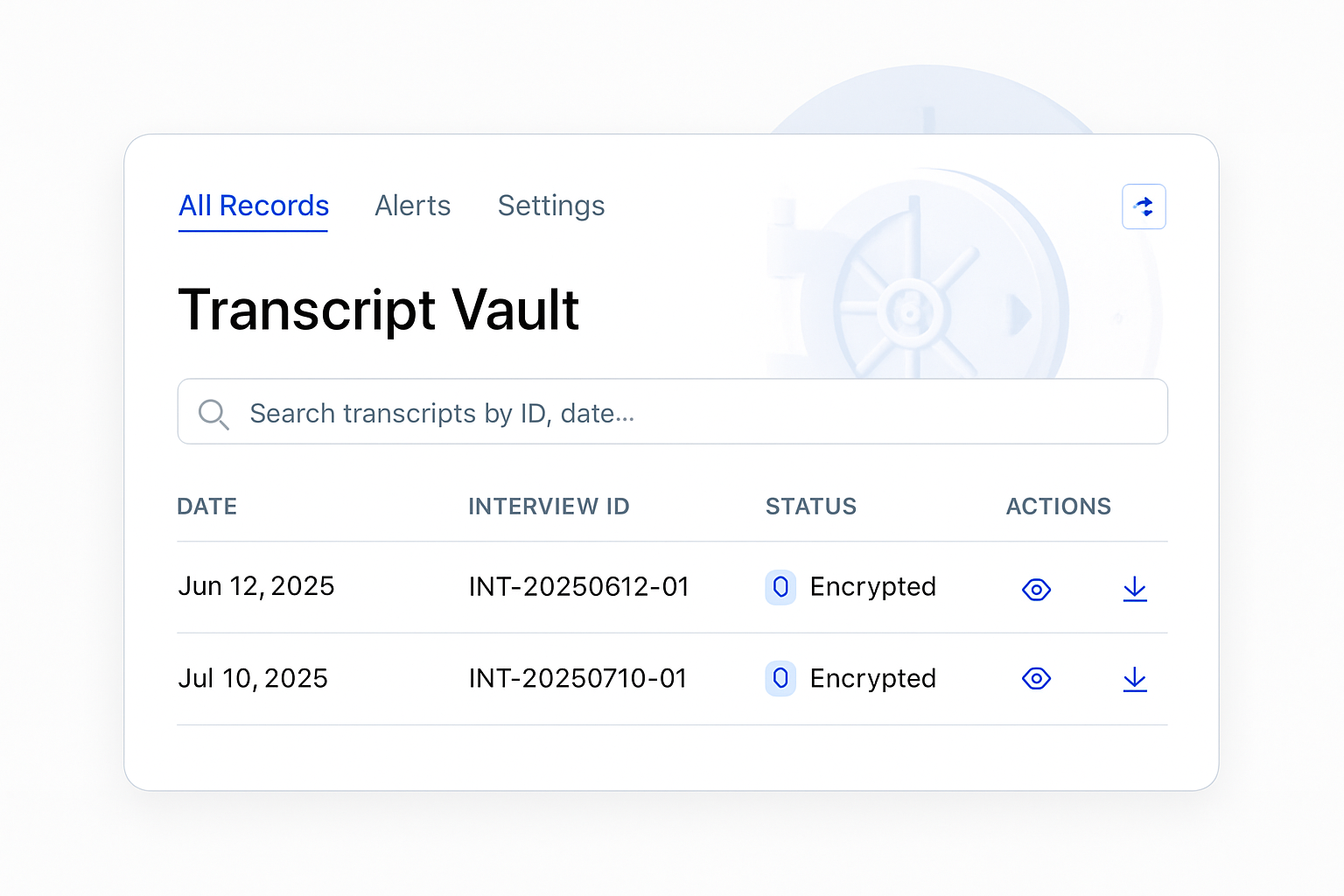

Encrypted Transcript Vault

Capture every interview transcript in tamper-proof, encrypted logs to support audit and regulatory requirements.

AI-Tailored Integration Checklists

Receive post-merger action items and due diligence follow-ups based on discrepancies and insights flagged by AI.

How AI Interviews Are Impacting Mergers & Acquisitions

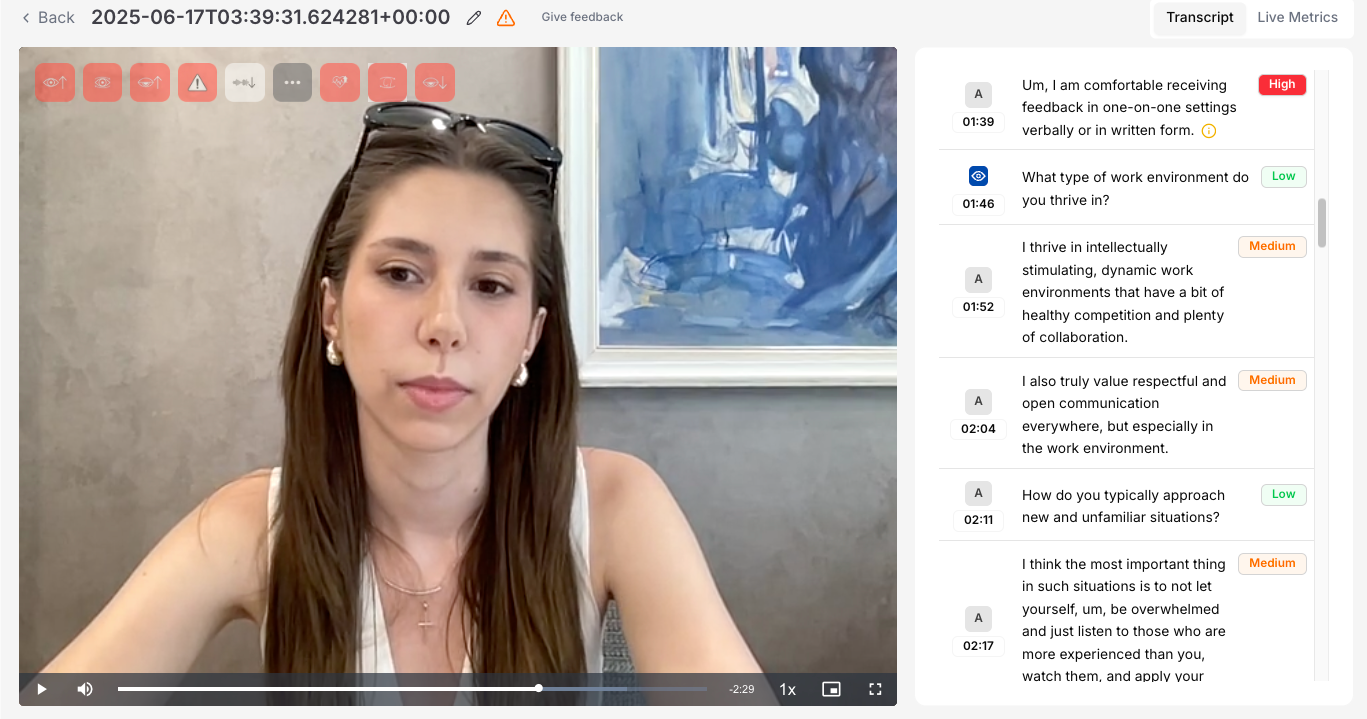

Mergers and acquisitions hinge on thorough due diligence and smooth integration, but traditional processes are slow, siloed, and prone to oversight. PolygrAI reshapes M&A by embedding AI-powered interviews at every stage. During target screening, structured interviews evaluate critical metrics, financial ratios, compliance flags, operational KPIs, delivering instant AI scores and commentary. Executive Q&As become more incisive as AI generates real-time follow-up prompts that probe assumptions and expose risks.

Post-deal, recurring AI check-ins track integration health: from cultural alignment to process adoption, ensuring leadership spots friction before it disrupts value creation. Live risk and synergy analytics turn qualitative conversations into quantifiable insights, guiding teams toward high-impact initiatives. Every conversation and insight is stored in a secure, encrypted vault, guaranteeing compliance with audit and regulatory mandates. By converting interviews into strategic data engines, PolygrAI accelerates deals, mitigates surprises, and drives seamless integration.

FAQ

Frequently Asked Questions

AI M&A due diligence uses automated interviews to assess financial, legal, and operational aspects of targets, delivering data-driven risk scores.

The platform schedules and conducts recurring AI interviews with integration teams to monitor progress on culture, processes, and synergies.

Yes. PolygrAI’s AI-driven prompts adapt in real time to responses, uncovering deeper insights during stakeholder discussions.

During interviews, AI analyzes behavioral and linguistic cues and maps them to risk and opportunity indicators, presented instantly on your dashboard.

Absolutely. All transcripts and analytics are encrypted and stored in tamper-proof logs to meet audit, regulatory, and LP reporting standards.

These are customized post-merger action items generated by AI based on gaps and opportunities identified during interviews.

Yes. Our APIs feed interview data and analytics into your deal tracking, CRM, and project management systems seamlessly.

Most M&A teams integrate via API and begin conducting AI-powered interviews within days, gaining accelerated insights immediately.

It does. PolygrAI’s AI engine handles multiple languages and respects regional compliance frameworks.

By automating screening, diligence, and integration interviews, AI slashes manual effort, minimizes errors, and speeds up deal cycles.

Try PolygrAI For Free

Ready to transform your M&A process with AI-powered interviews?