PolygrAI for Investment

Optimize deal sourcing, due diligence and investor engagement by automating interviews, maximising ROI and streamlining capital decisions.

We have been featured on

See All Features

Benefits

The benefits you will get on our platform

Accelerate Deal Sourcing

Automate pitch screening interviews to evaluate startup viability at scale and surface top opportunities faster.

Enhance Due Diligence

Deploy AI investment due diligence workflows that probe financial assumptions and risk factors without manual overhead.

Improve Investor Engagement

Streamline investor Q&A sessions with AI driven follow up prompts that keep discussions on point and deepen insights.

Maintain Portfolio Oversight

Schedule recurring portfolio performance reviews using AI portfolio review automation for continuous visibility.

Ensure Audit Ready Compliance

Store every transcript in secure, encrypted logs to preserve the chain of evidence and support regulatory and governance needs.

Features

Advanced features that can help you

Automate pitch screening interviews to evaluate startup viability, streamline investor Q&A sessions with AI-driven follow-up prompts, schedule recurring portfolio performance reviews, integrate real-time risk assessment analytics into every investment interview and maintain secure, audit-ready records of all meeting transcripts—all from one unified platform designed for modern investors and corporate development teams.

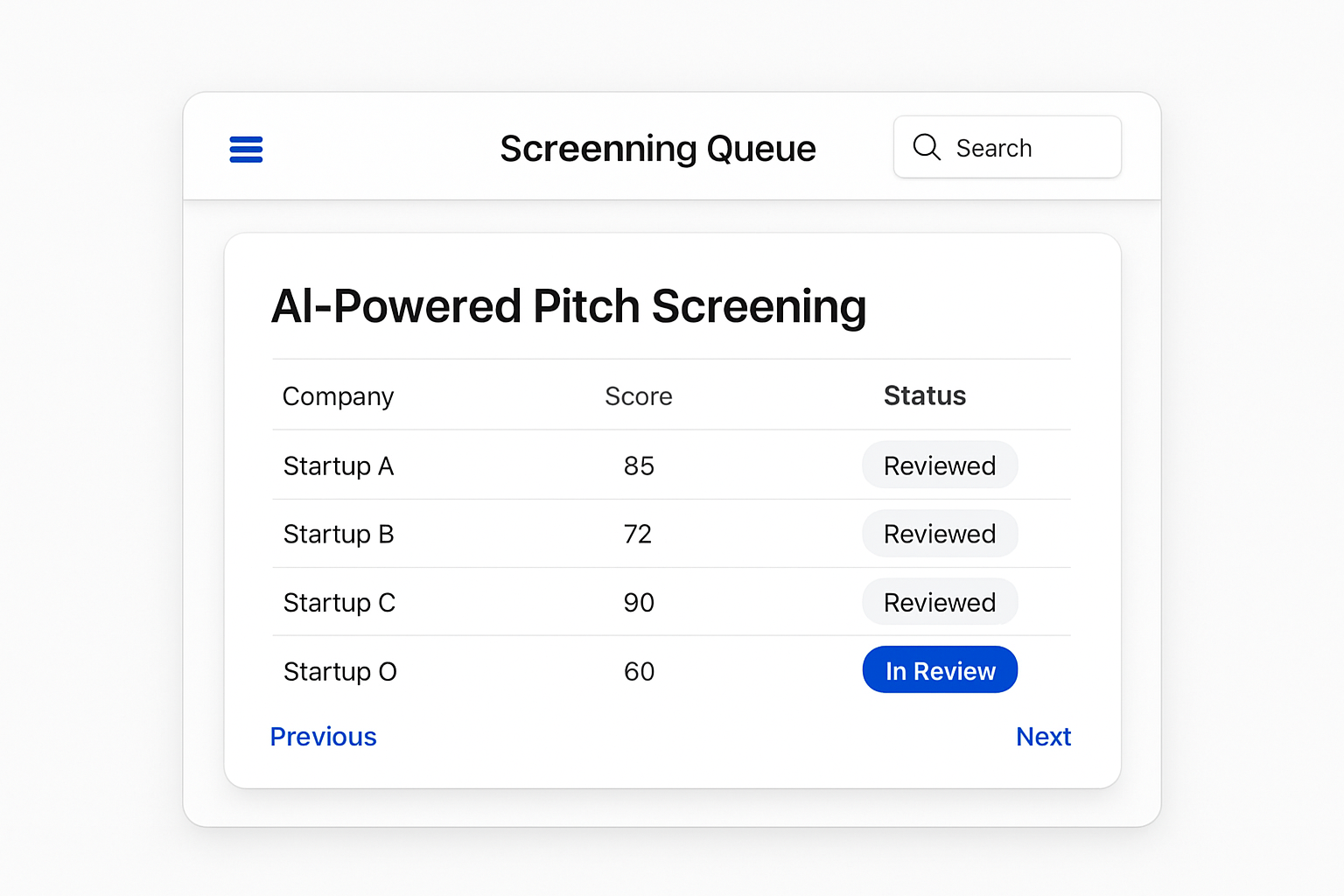

Automated Pitch Screening

Deploy AI driven interviews to assess business models financial projections and founder credibility in minutes accelerating deal flow.

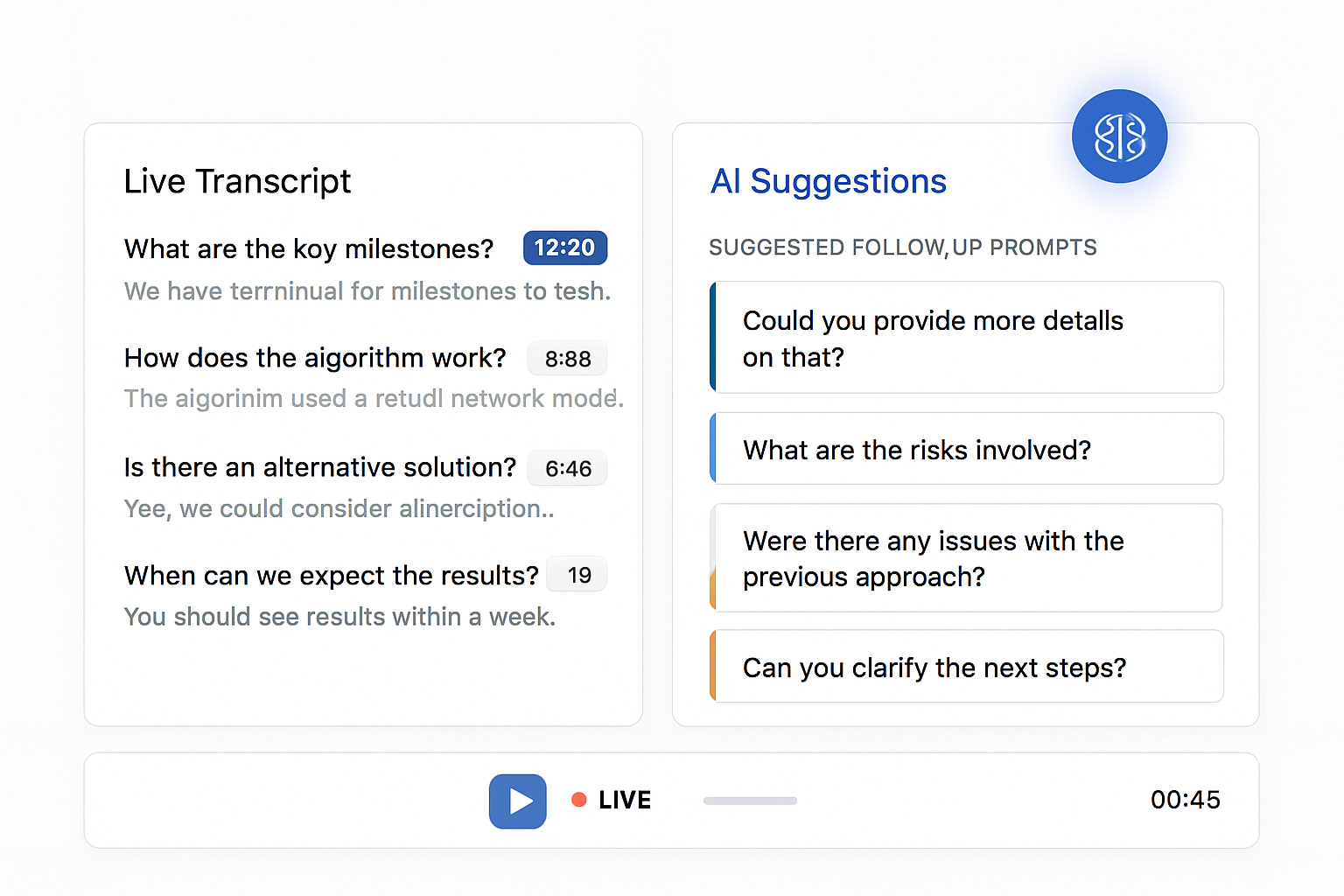

Investor Q&A Assistance

Generate dynamic follow-up prompts during live or recorded sessions to clarify assumptions, uncover risks, and maximise the value of each investor conversation.

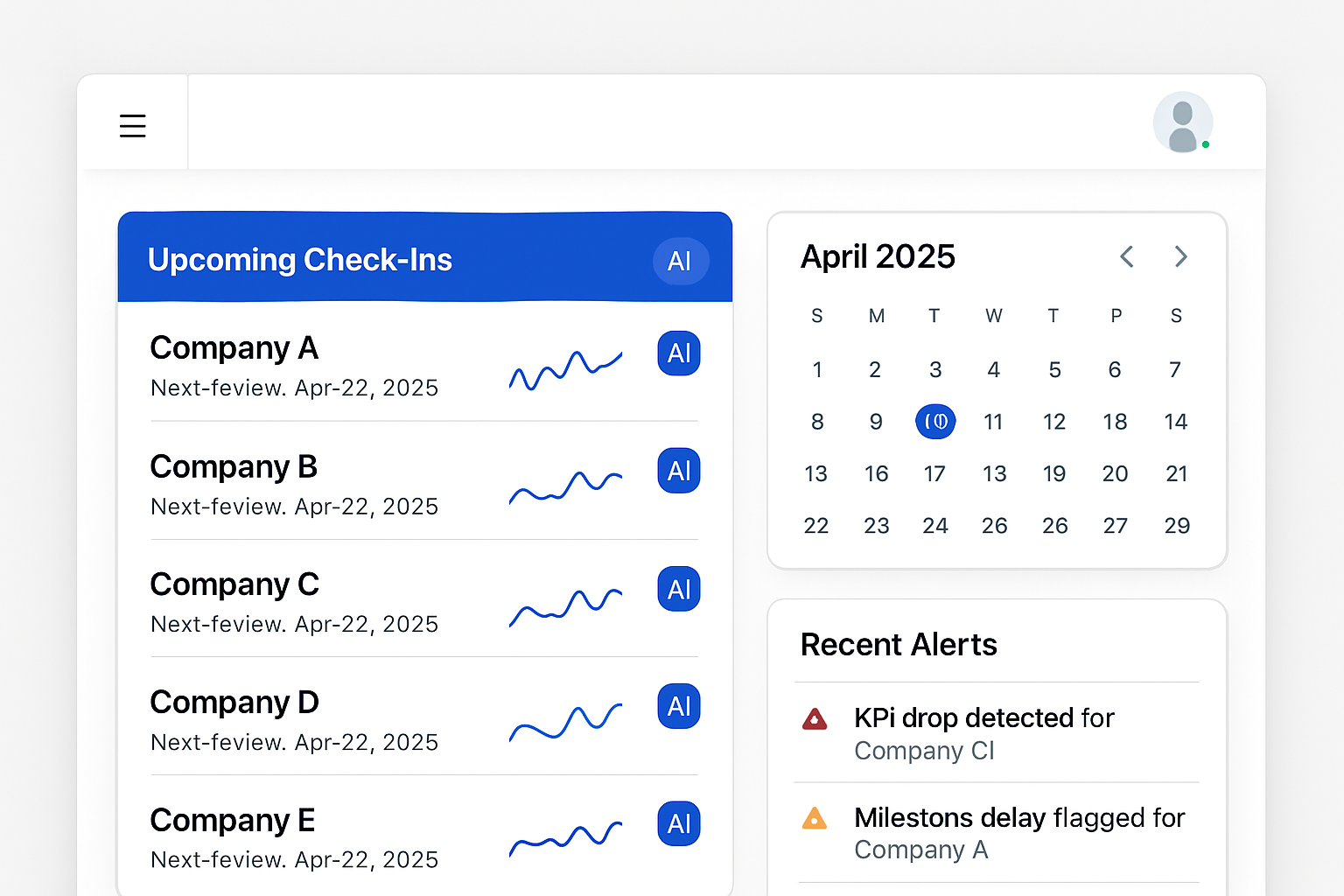

Recurring Portfolio Reviews

Schedule periodic AI powered check ins with portfolio companies to monitor KPIs track milestones and flag emerging issues before they escalate.

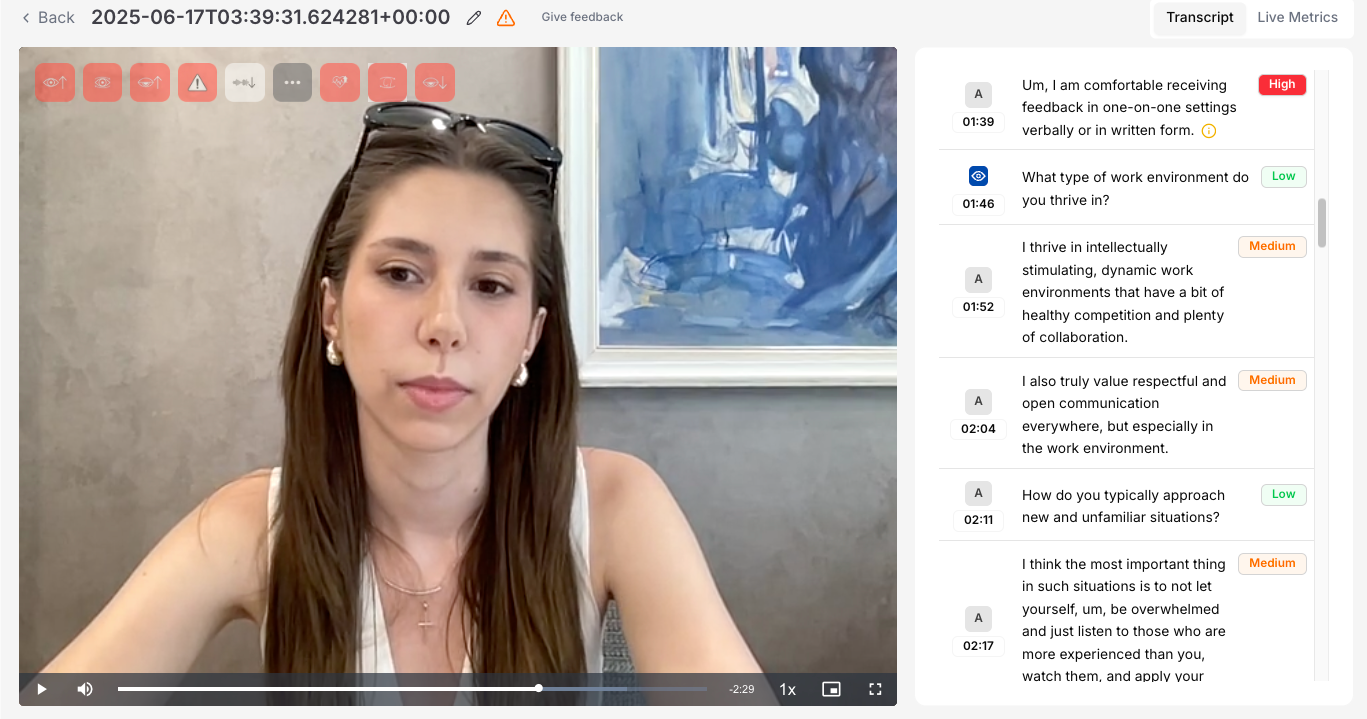

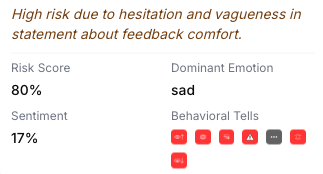

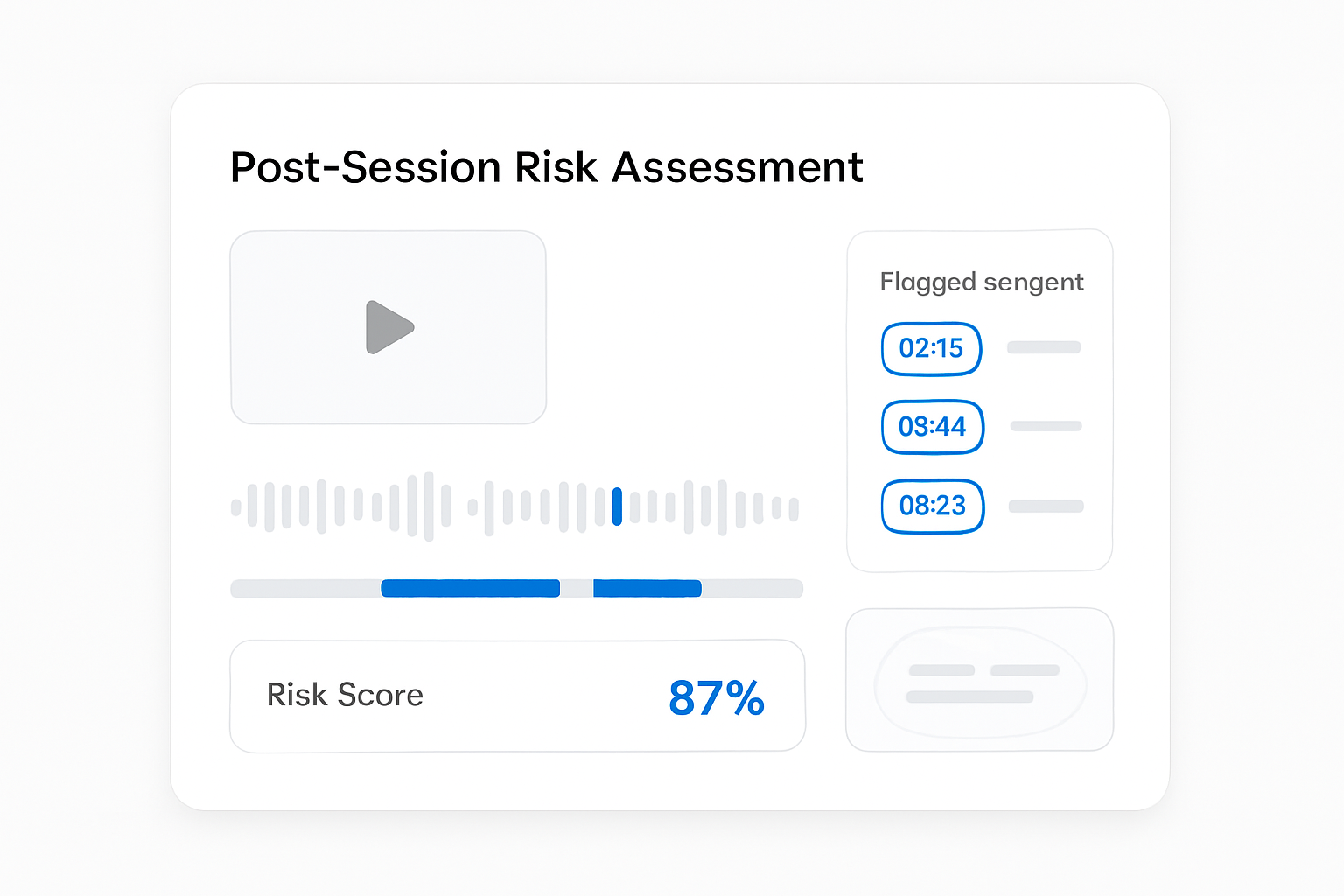

Risk Assessment

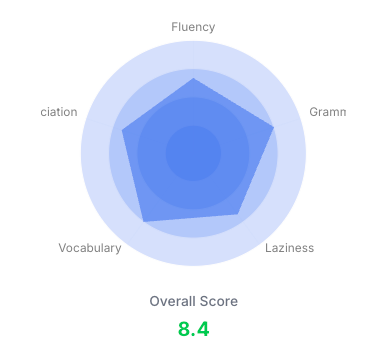

Post-session reports flag any answers or behavior patterns suggestive of potential fraud, enabling your team to review highlighted segments promptly and take informed action.

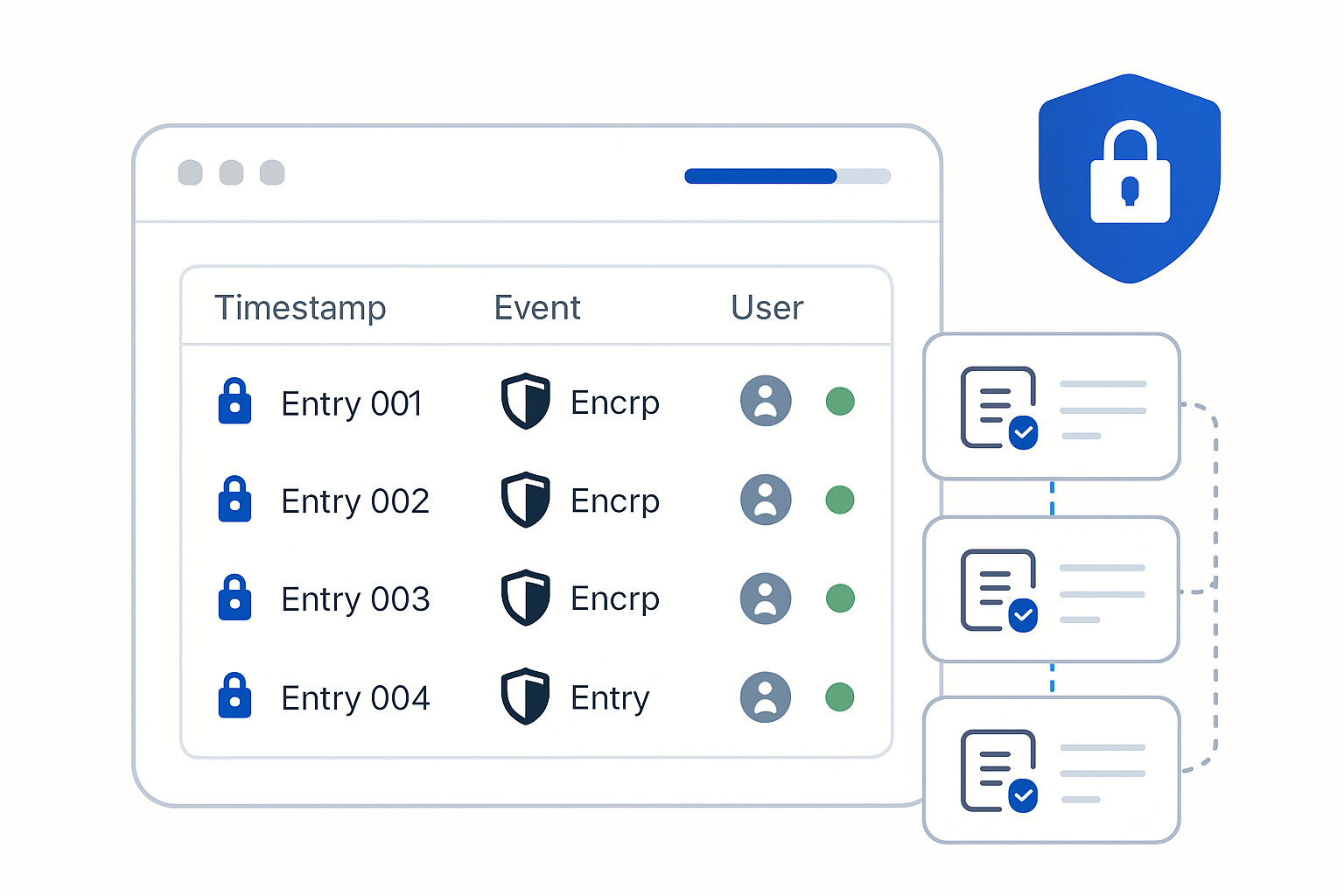

Secure Audit Trails

Record and encrypt all meeting transcripts and analytic reports in tamper-proof logs to ensure full compliance with audit and governance standards.

How AI Interviews Are Impacting Investment

The world of deal making moves faster than ever yet traditional processes remain manual time intensive and prone to bias. Sourcing new opportunities often relies on email threads and back to back calls that leave key details buried in transcripts and slide decks. PolygrAI changes that by embedding AI interviewer technology into every stage of the investment lifecycle. When a pitch deck arrives our platform can launch a structured interview that probes revenue assumptions team background and market potential. Responses are scored and summarised instantly giving investors a clear view of opportunity strength without reading every deck cover to cover.

Due diligence teams can now deploy AI investment due diligence interviews to explore legal financial and operational risk factors in a fraction of the time. The system generates follow up prompts on the fly based on founder answers, ensuring no critical detail is overlooked. Meanwhile portfolio managers benefit from scheduled AI portfolio review automation that produces regular health checks and flags performance deviations. By combining real time risk assessment with continuous monitoring, PolygrAI turns data overload into clear actionable insights.

For investor relations and capital raising teams, maintaining engagement is critical. AI driven Q&A assistance keeps conversations on track and explores areas of highest concern automatically. Every discussion and analytic summary is stored in an encrypted audit trail, providing a full compliance record for audit committees and regulators. This unified approach to sourcing, diligence and portfolio management reduces time to decision, maximises return on effort and empowers firms to capitalise on opportunities that would otherwise slip through the cracks.

FAQ

Frequently Asked Questions

AI investment due diligence uses automated interviews to assess financial, legal and market risks by analysing founder responses across multiple dimensions in real time.

Our platform launches structured interviews on submitted pitch decks, probing key metrics and scoring answers against custom risk profiles to prioritise deals.

Yes you can define custom question sets and scoring thresholds for AI interviewer workflows to match your fund’s unique investment thesis.

Absolutely all transcripts and analytic outputs are encrypted and stored in tamper proof logs to satisfy audit and governance requirements.

Most firms integrate our API and go live within days, gaining faster deal sourcing and streamlined due diligence almost immediately

Try PolygrAI For Free

Ready to transform your investment processes with AI-powered interviews?